In Cameroon, temporary occupation fees are imposed on individuals or businesses that utilize the public thoroughfare or its right-of-way for activities such as disposing of materials, exhibiting furniture or goods, and more.

These fees are regulated under the General Tax Code of Cameroon and are subject to specific regulations, rates, penalties, and a collection process. Let’s dive into the details.

Regulations for Temporary Occupation Fees

Section C 91: Activities Subject to Fees

– Definition: Temporary occupation fees apply to the disposal of materials like sand, stones, wood, as well as the exhibition of furniture, goods, or any other objects in the public thoroughfare or its right-of-way.

If this article helped you, you can support our work at OpenHub.

Support OpenHub Digital– Exemptions: Certain entities are exempt from these fees, including service stations, vehicles, and advertising media.

Section C 92: Authorization and Payment Process

– Prior Authorization: Any temporary occupation of the public highway requires approval from the competent head of the municipal executive. The authorized duration of the occupation will be determined by the municipal executive.

– Fee Payment: The fees must be paid at the counter of the municipal revenue collector upon presentation of the authorization.

– Unauthorized Occupation: Unauthorized occupation or dumping of materials without municipal authorization may result in the payment of a tax equal to double the applicable fees, unless force majeure can be proven.

Section C 93: Rate and Penalties

– Fee Rate: The municipal council sets the maximum rate for temporary occupation fees, which is currently capped at 2,000 CFA Francs per square meter per day.

– Penalties: Non-authorization, reduction in the occupied area, or late payment may result in a fine amounting to 100% of the principal fees due.

Collection Process and Impounding

– Impoundment: In cases where the owner, caretaker, or responsible official cannot be located or fails to comply with the temporary occupation requirements, the council has the authority, after proper notification through posting or radio, to impound the property.

Importance of Temporary Occupation Fee Compliance

The implementation of temporary occupation fees aims to ensure proper management and control of activities on public thoroughfares in Cameroon.

By imposing fees, requiring authorization, and enforcing penalties, the government aims to maintain order, prevent disruptions, and promote compliance with the law.

Understanding the regulations, rates, penalties, and collection process of temporary occupation fees in Cameroon is crucial for individuals and businesses utilizing the public thoroughfare. Compliance with these regulations helps maintain an organized and efficient public space while avoiding potential fines or impoundment.

By following the guidelines set forth by the General Tax Code, individuals and businesses can ensure a smooth and lawful temporary occupation of the public thoroughfare in Cameroon.

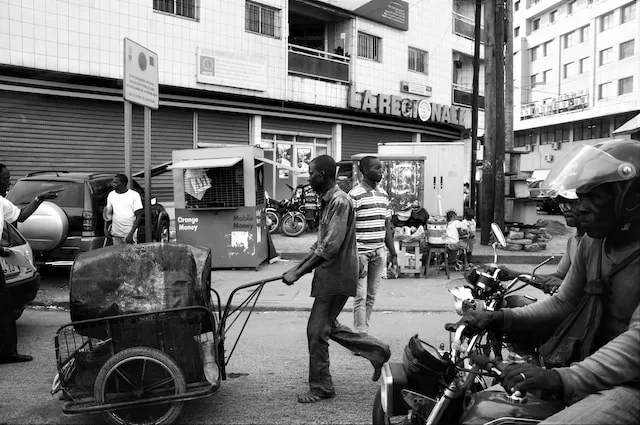

Photo by Edouard TAMBA on Unsplash

OpenHub Consulting Ltd

OpenHub Consulting offers comprehensive services to support your business’s needs. From bookkeeping and tax declaration to company incorporation, our expert team is here to assist you.

If this article helped you, you can support our work at OpenHub.

Support OpenHub DigitalWith our customized small business accounting solutions, you can trust that your financial records are accurate and up-to-date.

We also specialize in tax declaration services, ensuring that your business remains compliant with tax laws.

And when it comes to company incorporation, we streamline the process, guiding you through each step with precision. Visit openhubconsulting.com to learn more about how our services can benefit your business.

From Insight to Implementation

Going through the administrative and legal landscape in Cameroon requires more than just information—it requires a grounded local partner. At OpenHub Consulting, we specialize in helping the diaspora and international investors turn their business visions into compliant, operational realities.

If you are ready to move forward, our team is prepared to manage your registration and compliance from start to finish.

Start Your Company Incorporation →Discover more from OpenHub Digital

Subscribe to get the latest posts sent to your email.