The 2025 Finance Bill of Cameroon introduces several provisions aimed at modernizing the fiscal system while encouraging economic growth.

Simplifying Tax Amnesty Programs Under the 2025 Finance Bill

The 2025 Finance Bill of Cameroon introduces several tax amnesty programs aimed at encouraging businesses to regularize their tax situations.

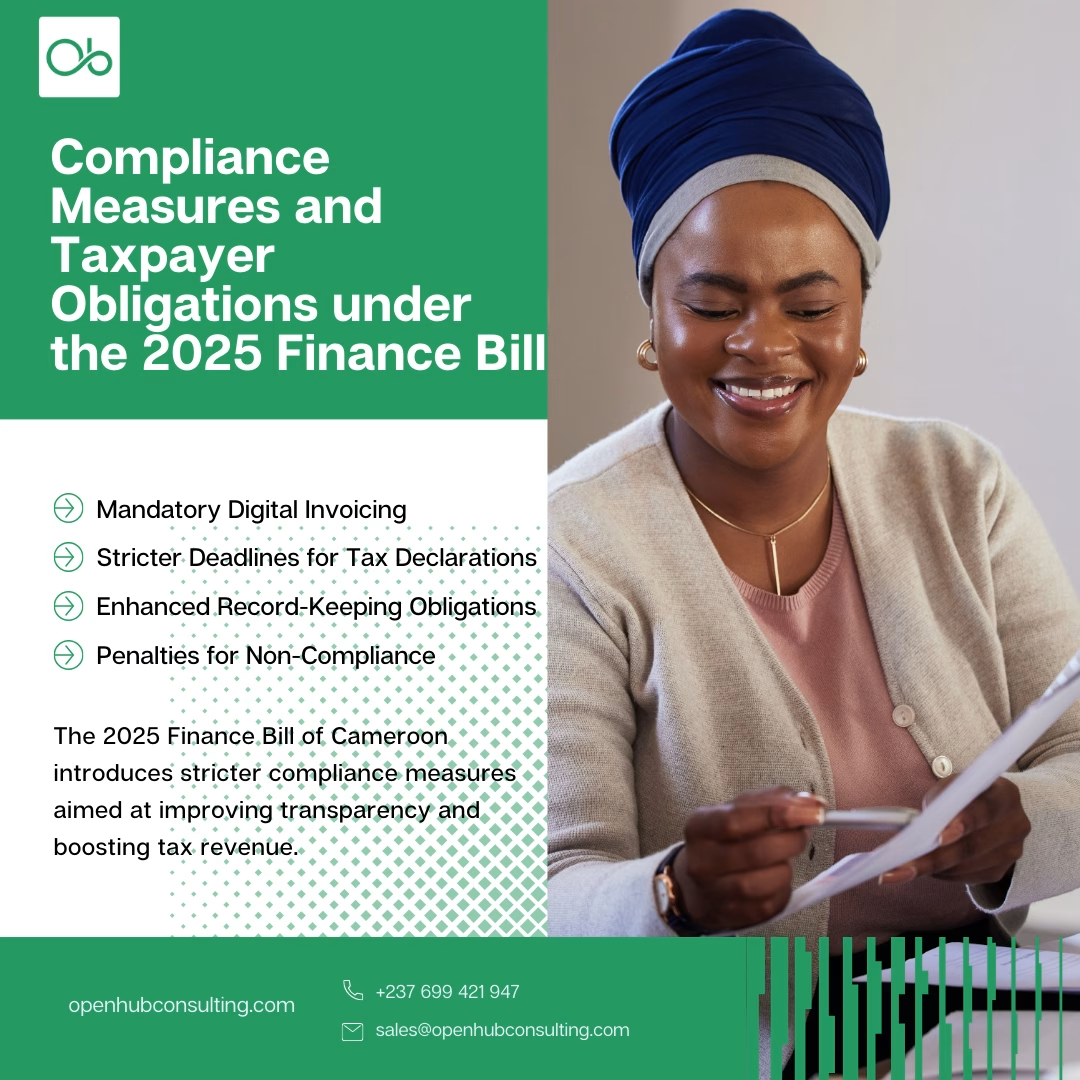

Compliance Measures and Taxpayer Obligations under the 2025 Finance Bill

2025 Finance Bill of Cameroon introduces stricter compliance measures aimed at improving transparency and boosting tax revenue.

2025 Finance Bill: Tax Incentives for Green Technology

The 2025 FInance Bill of Cameroon has given provisions for tax relief for green technology initiatives in Cameroon.

Expanding the Scope of Taxable Industrial and Commercial Profits in Cameroon

Learn about the extended scope of taxable industrial and commercial profits in Cameroon as outlined in Section 51 of the tax code.

#taxableincome #commercialprofits #industrialprofits #realestate #Cameroon

Taxable Income for Handicraft, Industrial, and Commercial Profits in Cameroon

Explore the assessment of taxable income from handicraft, industrial, and commercial activities in Cameroon as outlined in Section 50 of the tax code.

Ascertaining the Taxable Basis for Various Types of Income in Cameroon

Learn how taxable income is assessed for various types of income, including stocks, bonds, loans, and deposits, under Section 44 of the Cameroonian tax code.

Exemptions from Personal Income Tax in Cameroon

Learn about the various exemptions from personal income tax in Cameroon as detailed in Section 43.

Taxation of Income from Digital Assets in Cameroon

Understand the taxation of income from digital assets in Cameroon as outlined in Section 42a.

Taxable Profits from the Transfer of Stocks, Bonds, and Other Capital Shares in Cameroon

Learn about how profits from transferring stocks, bonds, and capital shares are taxed in Cameroon under Section 42. Get insights on tax obligations and exemptions.