The 2025 Finance Law introduced changes to some personal income tax rates and how it’s calculated for some income types.

Tax Filing Process for Beauty Businesses in Cameroon

Tax Filing Process for Beauty Businesses in Cameroon. Meeting deadlines to ensuring accuracy, use the right tools and strategies.

How the 2025 Finance Law Changes Affect Your Small Business in Cameroon

Changes in the 2025 Finance Law Affecting the Basis of Assessment for some aspects of Personal Income Tax in Cameroon

Understanding Tax-Deductible Expenses for Beauty Businesses in Cameroon

Understand Tax-Deductible Expenses for Beauty Businesses in Cameroon. Lower your tax liability by identifying tax-deductible expenses.

Accounting Best Practices for Beauty Businesses in Cameroon

Accounting Best Practices for Beauty Businesses in Cameroon. You can reduce costs, avoid penalties, and boost your bottom line.

Tax Tips for Maximizing Profitability in Beauty Businesses

Tax Tips for Maximizing Profitability in Your Beauty Business. Maximizing profitability starts with managing your taxes effectively.

Tax Compliance 101 for Beauty Businesses in Cameroon

Tax Compliance 101 for Beauty Businesses – Check out these Key Tax Obligations for Beauty Businesses in Cameroon

How to Leverage the 2025 Finance Bill to Grow Your Business

The 2025 Finance Bill of Cameroon introduces several provisions aimed at modernizing the fiscal system while encouraging economic growth.

Simplifying Tax Amnesty Programs Under the 2025 Finance Bill

The 2025 Finance Bill of Cameroon introduces several tax amnesty programs aimed at encouraging businesses to regularize their tax situations.

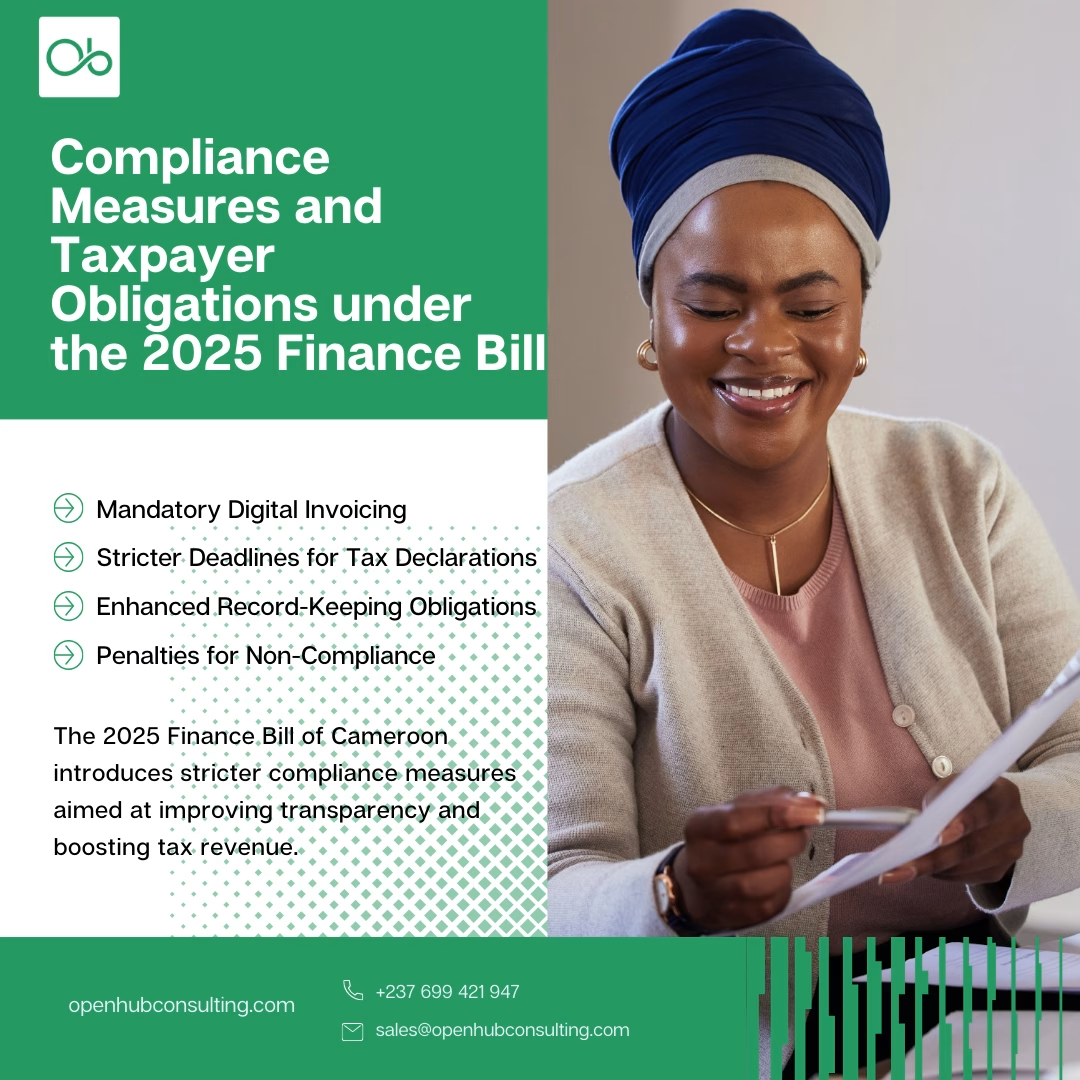

Compliance Measures and Taxpayer Obligations under the 2025 Finance Bill

2025 Finance Bill of Cameroon introduces stricter compliance measures aimed at improving transparency and boosting tax revenue.