Celebrities or public figures are always on the spotlight. There are times their stars shine to the extent it blindfolds their audience. We have all seen celebrities or […]

Do you know you can influence how and what people think about your brand?

The Internet has become the basic tool to search for information about everything we want to know. Our fingers have become so search-engine friendly that when we don’t […]

Become a Professional Freelance Writer and Blogger

When I started writing online, it was just like having one of my dreams come true. I really loved writing but never knew I will instead become a […]

Are You Setting up a Business in Cameroon?

Are you setting up a business in Cameroon or plan to do so in the nearest future? I will be sharing with you the most common types of […]

What are the Accounting Obligations of a Trader in Cameroon

Before we delve into the accounting obligations of a trader, you need to know who a trader is in the context of Cameroon. A trader is an institution […]

Who is a Trader in Cameroon

I was giving a WhatsApp talk on Men’s Diary yesterday and I asked “who is a trader?”. One person said a buyam-sellam. He was not wrong, though that’s […]

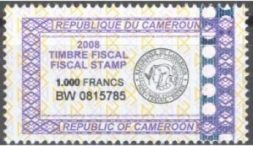

Cameroon: Fiscal stamps to be sold online

The Prime Minister of Cameroon, Joseph Dion Ngute, signed a decree relating to the management of stamp duties and other fiscal values. Decree No 2019/2652/PM of August 5, […]

See What Unregistered Forestry Companies in Cameroon Pay as Tax

Hope you did understand the last post where I shared with you 6 basic tax tips for businesses in Cameroon. That may not be all, but you needed […]

6 Basic Tax Tips for Businesses in Cameroon

Once you start a business in Cameroon, one of the basic rule is to know about your tax regulations. Many small business owners rarely take the basic tax […]

Cameroon – The Syndrome of Never Meeting Project Deadlines

I know many will think this post is for for public contractors in Cameroon who never meet deadlines for projects. It talks more on freelance technicians who are […]