BUSINESS INCORPORATION

August 13, 2021

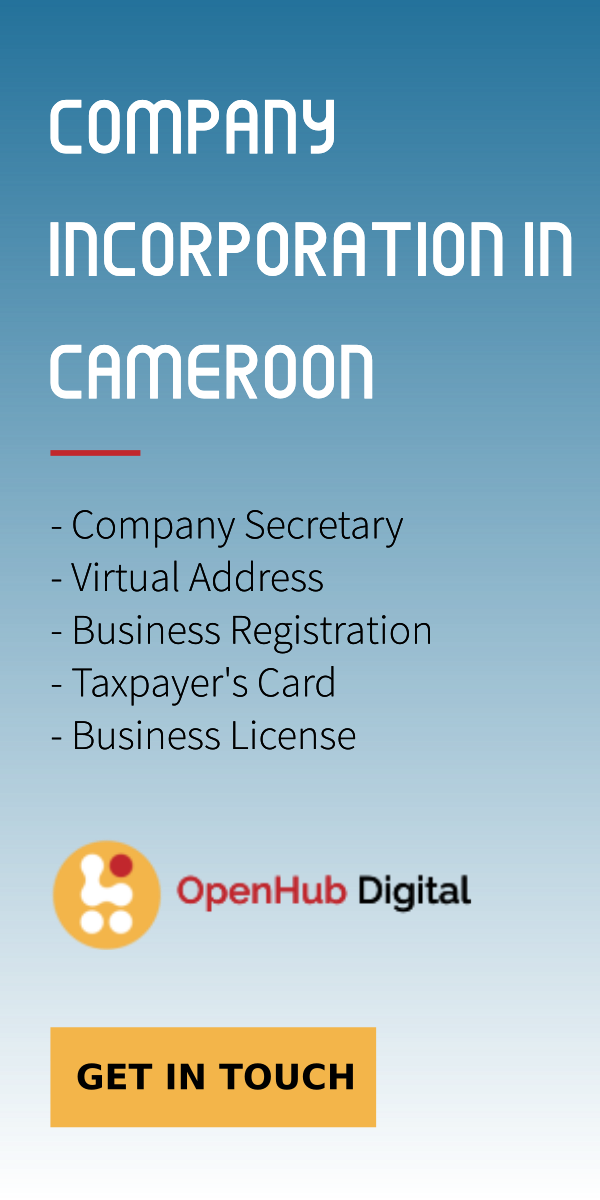

Are you ready to start a business in Cameroon? I be sharing with you today the compliance and legal requirements to register a company in Cameroon.

August 10, 2021

Most entrepreneurs come up with reasons to justify their not starting a real business. They focus more on the practical aspects of the business, which is not bad, but incomplete.

Highlights

Web Design

Productivity

Business Plans

Customs

Marketing & Branding

Tech & Innovation

GROW YOUR BUSINESS

July 22, 2019

[…]

May 22, 2019

New Business Alert:

Soulmates Biznes Empire Quality Management Consultancy opens its doors to the public in Douala, Cameroon.

March 7, 2019

[…]

TAX & LEGAL TIPS

November 17, 2023

Open-end investment firms, known as SICAVs (Société d'Investissement à Capital Variable), are financial structures pooling funds from investors for diversified portfolio investments like stocks, bonds, or other instruments. Offering unlimited shares, SICAVs offer liquidity and risk diversification, while being subject to regulatory oversight for investor protection. These companies are tax-exempt in Cameroon.

November 16, 2023

Mutual investment funds pool capital from numerous investors and offer access to professionally managed, diversified investment portfolios. They have varying objectives like capital appreciation and income generation, detailed in the prospectus. Managed by professionals, mutual funds issue, redeem units as per investor interest and follow robust risk management practices. They're subjected to regulatory oversight for investor protection and transparency. Interestingly, they are exempted from paying company tax in Cameroon.

November 15, 2023

Cooperative societies are voluntary associations that promote the economic and social well-being of their members by pooling resources and undertaking collective activities. Key features include democratic control, active member benefit, limited return on capital, and emphasis on education and training. These cooperatives operate across various sectors and can increase bargaining power, improve resource access, and promote sustainable practices. Cooperatives' structure and benefits are subject to local regulations, such as tax exemptions in Cameroon. Assistance is readily available for those interested in forming or participating in cooperatives.

November 28, 2023

Technology start-ups in Cameroon enjoy a reduced 5% tax rate on income from movable capital revenue, dividends, and interest payments, as part of a government initiative designed to encourage entrepreneurship and technology investment. The aim is to stimulate growth in the digital economy. Start-ups and investors are advised to consult tax professionals to fully understand the scope and conditions of these incentives.

November 28, 2023

Cameroon's General Tax Code offers tax advantages and incentives to ICT start-ups registered in approved management centers to foster innovation and support the digital economy. During the incubation phase, start-ups are tax exempt, giving them financial freedom to focus on growth. Technological innovation is encouraged through a 30% income tax credit on associated expenses. During the operational phase, further benefits continue, such as reduced tax rates, exemptions, and preferential rates on capital gains from sales. After five years, start-ups transition to the regular tax system, maintaining their established foundations.

November 28, 2023

Income tax credit, a government incentive, enables taxpayers to lessen their tax liability. For instance, in Cameroon, start-ups engaging in research and innovation can benefit from a tax credit of up to 30% on their expenses, capped at 100 million CFA francs. This incentive encourages technological advancements, job creation, and overall economic growth.

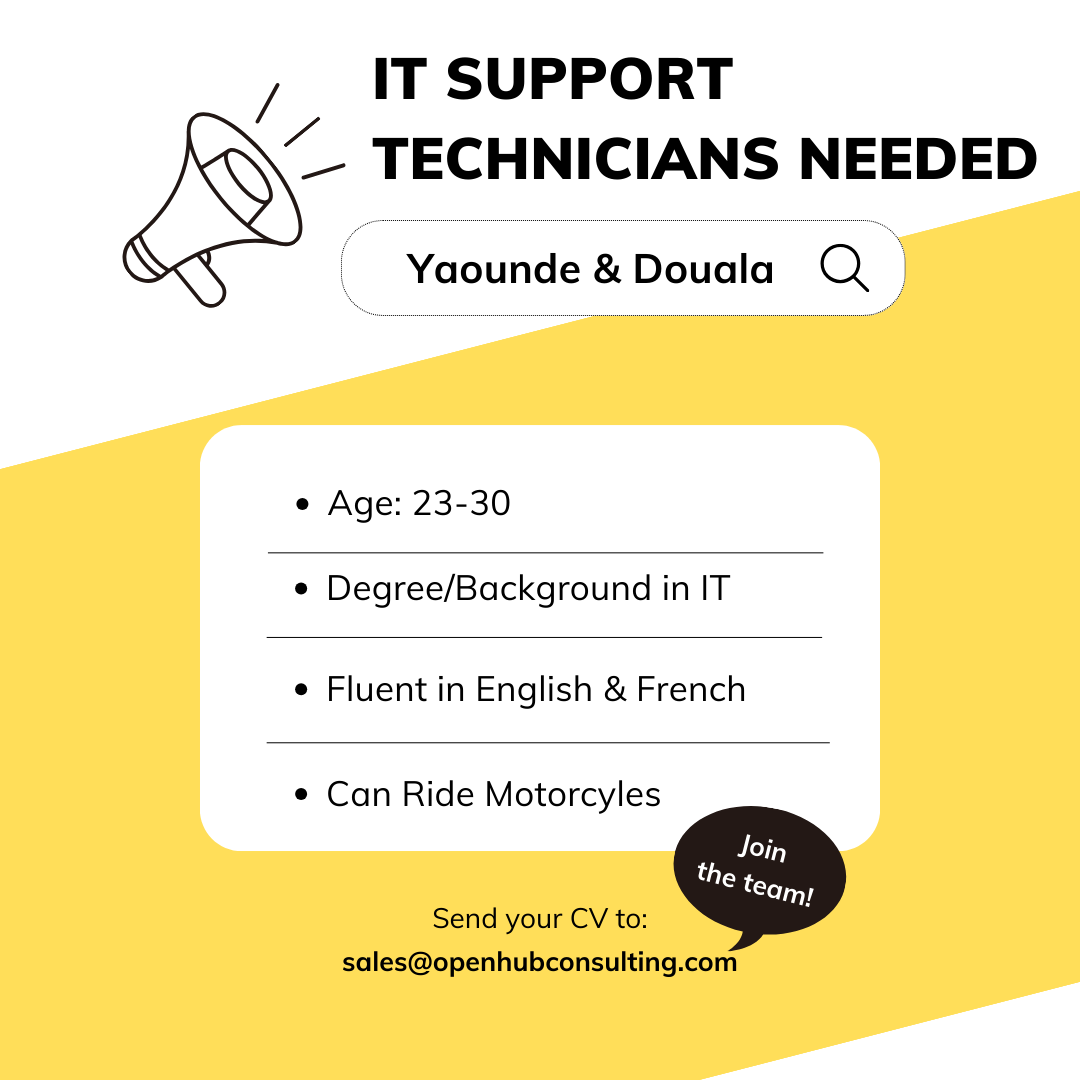

November 27, 2023

IT Support Technicians needed in Yaounde and Douala to placed on-site with clients to provide technical support, software installations, and troubleshooting services.

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- Agriculture

- beauty

- Business Ideas

- Business Incorporation

- Business Plans

- Business Tips

- Clients

- Commodities

- Content Writing

- Customs

- Finance

- Français

- Guest Post

- Job

- Legal

- Local Tax

- Marketing & Branding

- News

- Newsletters

- Productivity

- Reviews - Press release

- Sponsored Content

- Tax

- Tax Obligations

- Tech

- Tech & Innovation

- Training

- Uncategorized

- Verified Business

- Videos

- Web Design

- All

- #KnowYourTaxLaw Tax Law Cameroon

- #NOSO

- #OpenHub

- 15 Mars 2019

- 2017 Finance aw

- 2017 Finance law

- 2018 FInance Law

- 2019

- 2019 Cameroon Finance Law

- 2019 Finance Law Cameroon

- 2019 Finance Law of Cameroon

- 2019 Finance Law workshop

- 2020 Chevening Scholarship

- 2020 finance law

- 2020 Finance Law of Cameroon

- 2021 Draft Finance Bill

- 2021 Finance Bill

- 2021 finance law

- 2023 DSF

- 2023 Finance law

- 2023 Tax Season

- 2024

- 2545 business consulting

- 3conex

- 3D modeling

- 50% Abatement

- A Man For The Weekend

- accelerator program

- accounting

- accounting checklist

- accounting services

- accouting

- achievment

- Achiri Nji

- activspaces

- Actual Earnings Tax System

- Addis Ababa

- additional council tax

- Administrative Assistant

- advertising

- Advertising Agency

- advertising hoarding

- Advertising hoardings

- advertising tax

- AEA 2018

- AFA

- Africa

- Africa Businesses

- Africa Content

- Africa content writing

- Africa Content writing jobs

- Africa Finance Academy

- Africa Got Talent

- African Entrepreneurs

- African Entrepreneurship Award

- African hollandais

- African Kente fabric

- African Print

- African print fabric

- African print fabric store

- african woman

- african women

- africaplans

- africapolicies

- agape welding school

- agreements

- agribusiness

- agricultural business

- Agricultural sector

- agricultural techniques

- agriculturalpolicies

- Agriculture

- agriculture in cameroon

- agricuture

- agripreneur

- AgriTech

- agro-transformation

- AISCON 2019

- akwajobs

- Amazon

- ambulant vendors

- Anaemia

- and Freight)

- Anemia

- Angela Carine Essouma

- Anglophone Crisis

- animation

- ankara fabrics

- annual accounts

- aquaponic

- Arcange Eca

- Arrey Echi

- Arthur Zang

- Arts

- Arts Exhibition

- Ashley Nanga Kelly

- Aspiring Entrepreneurs

- assessment

- auctioneers

- Audiovisual tax

- Audits

- authorization requirements

- authorized share capital

- AVENTIS

- Award competitions

- ax Returns

- baby dresses

- BAI Gallery Space

- bamenda

- Bamenda Coffee

- Ban'Tikar Arts Workshop

- banana fibre

- Banana stalk

- Banana Stalks

- Bangor Art Initiative

- Bangor Gwynedd

- Bank Account

- bank transfer

- banks

- banks in cameroon

- Barbershop business in Cameroon

- benefits of modern agriculture

- Bénin

- best businesses

- Best content marketing in Africa

- betting

- BICEC

- BICEC Cameroon

- Big G Baba

- billboards

- Biodegrable paper bags

- bleach cream

- bleaching

- Blesolac

- Blogger

- blogging

- BMCE Bank of Africa

- Bonamoussadi

- book

- bookkeeping

- boot camp

- bootcamp

- Box lunch business

- Brand

- Brand Ambassador

- brand identity

- brand values

- branding

- Brian Gitta

- btl marketing

- budget

- budgeting

- budgeting for small business

- buea

- building permit fees

- Business

- business agreements

- Business Bank Account

- business budget

- business budgeting

- Business Can Be Fun

- business challenges in Cameroon

- business compliance

- business consulting services

- Business contracts

- Business Creation

- business creation in Cameroon

- business cycle

- Business Expenses

- business forms

- Business Idea

- Business Ideas

- Business in Cameroon

- business incorporation

- business law

- Business Licence

- business license

- Business License Cameroon

- Business License Tax

- Business model

- business modification

- business opportunities

- Business Plan

- business plan writing

- business plans

- Business Registration

- Business Registration in Cameroon

- Business registration services

- business regulations

- business success

- Business Tips

- Businesses with low-cost starting

- buyam

- Buying price

- by-product tax

- Cabinet David Partners

- cacao

- camer agricom

- Cameroon

- Cameroon 2017 Tax Law

- Cameroon 2018 Tax Law

- Cameroon 2019 Finance Law

- Cameroon App

- Cameroon company incorporation

- Cameroon Customs Duties and Taxes

- Cameroon Development Corporation

- Cameroon economy

- Cameroon Export procedure

- Cameroon Foreign Investment

- Cameroon General Tax Code

- Cameroon General Tax Code 2018

- Cameroon income tax calculator

- Cameroon Investment Incentives

- Cameroon local tax

- Cameroon Manual of Tax Procedures

- Cameroon Soccer News

- Cameroon Tax

- Cameroon tax administration

- Cameroon tax law

- Cameroon Tax System

- Cameroon tax systems

- Cameroon Taxation

- Cameroon Wages

- Cameroonian moms

- cameroun

- Capital Gains

- Capital Gains Tax

- Capital Gains Tax in Cameroon

- car park occupation duties

- Caramel

- Cardiopad

- carpenter

- cash crop

- casino business

- Cassius Clay

- cattle farming

- cattle slaughter tax

- cattle tax

- CDC

- celebrity

- certificate of non-indebtedness

- Certified Ads

- Certified Advertisement

- Certified Adverts

- CGI

- CHad

- Changing Africa

- Chartering Services

- Chartering skilled staff

- chef dawei

- Chevening

- Chevening Scholarship

- Child Entrepreneur

- Child shareholder

- Children Entrepreneur

- chocolate

- choosing a name

- Christmas

- Christmas in Cameroon

- Churchill Nanje

- CIF (Cost

- classification

- Classified ads

- Classified Advertisement

- Classified Advertisements

- Classifieds

- Clean your image

- Client's voice

- Clothing business

- Cloths design business

- cnps

- Co-working space in Cameroon

- coaching

- cocoa

- cocoa business ideas

- cocoa butter

- cocoa farm

- Cocoa prices

- Coconut Oil

- coding

- coding for kids

- coding4kids

- collection process

- commercial farming

- Commodity prices

- common mistakes business owners make

- Community Manager

- company creation

- company incorporation

- Company incorporation in Cameroon

- company name

- Company Registration

- company shareholder

- company tax

- Company Tax in Cameroon

- competitor

- Compliance

- comprehensive solutions

- comprehensive training

- CompTIA

- Computers

- conflict

- Confusion

- Congo Brazza

- Construction Industry

- consultants

- Consulting

- content

- content creation

- Content marketing

- Content marketing in Cameroon

- content writing

- Contracts

- Cooperative societies

- Coronavirus

- Corporate bank account

- Corporate Banks

- Corporate Tax

- Corporate Tax in Cameroon

- corporate tax rate

- corporate title

- corporate titles

- corporation tax

- cosmetics

- Côte D'ivoire

- council cattle tax

- council levies

- council stamp duty

- council tax

- council transit tax

- councils

- courier

- course manuals

- Covid-19

- Coworking Space

- Creative Arts

- creche

- crew management

- Custom Duties and Taxes

- custom house brokers

- custom-made furniture

- customs duties in Cameroon

- Cyber Defense

- cyber security

- Davido

- daycare

- deadlines

- declaration

- déclaration statistique et fiscale

- Déclarations Statistiques et Fiscale

- Déclarations Statistiques et Fiscales

- decoration

- Decree

- delivery agent

- Denis Barika

- Designer

- Digital content marketing

- Digital Marketing

- digital renter

- digital transactions

- Digitization of taxes

- Dion Ngute

- Direct taxes

- Directorate General of Taxation

- disaster zones

- discharge tax

- Discharge Tax Cameroon

- Disruptive Entrepreneur

- dividends

- documentation marine consultancy

- Doing Business in Cameroon

- Douala

- DR Congo

- dr javnyuy joybert

- dropshipper

- Dropshipping

- Dropshipping Business

- DSF

- Dsicharge tax

- duties

- E-commerce

- e-commerce business

- e-commerce news

- e-commerce website

- e-courses

- e-logistique

- EarthDay

- eat

- ebooks

- Ecobank

- Ecobank Cameroon

- economic disaster zones

- Economic Empowerment

- Economic factors

- economic interest groups

- education sector

- Ekwang

- email marketing

- employee

- employer

- empowerment

- enforcement

- ENP

- entertainment tax

- entrepreneur

- Entrepreneur Events for November

- Entrepreneurial Competitions

- entrepreneurial journey

- Entrepreneurial Myths

- Entrepreneurs

- entrepreneurs in Cameroon

- Entrepreneurship

- Entrepreneurship Awards

- Entrepreneurship Notes

- Entrepreneurship Students

- Environment

- environnement

- Eru

- Ess.BE

- Esse.BE Ltd

- Ethiopia

- etraining

- excise duty

- excise tax in Cameroon

- Executive Summary

- Exemption from VAT

- exemptions

- expert insights

- Export

- Export & Import Business In Cameroon

- Export Business

- export tax

- Exporters

- External funding

- fabric sales

- fabric sales & discounts

- fabric store

- Facebook Messenger Kids

- Family & friends

- Farmers

- farming in Cameroon

- farmland in cameroon

- Fashion

- Fashion business

- Fashion designer

- Fashion designer in Douala

- Fashion designer in Yaounde

- Fashion designers in Cameroon

- fashion fabrics

- Fast Track Excel

- fastfood

- Feem

- FEICOM

- File Income Taxes

- file returns

- File Transfer

- finance

- Finance Law

- Finance Law 2019 Cameroon

- Finance law 2020

- Finance Law 2021

- finance law 2023

- Finance Law Cameroon

- Finance Law of Cameroon

- Finance Law of Cameroon 2019

- Finance Law training

- financement

- Financial Compliance

- Financial Incentives

- financial independence

- Financial Institutions

- Firearms tax

- fiscal stamps

- fish

- Fisheries

- Flat Rate Tax

- Flavien Kouatcha

- FOB (Free on Board)

- food

- foodguide

- Forensics

- forest exploitation

- Forest royalty

- forestry tax

- Formality Centers for Enterprise Creation

- forwarding and clearing agents

- France

- Free Downloads

- free invoice generator

- Freelance Content Writer

- Freelance writer

- Freelance writing

- Freelance Writing Business

- Freelancers in Cameroon

- freight contractors

- fresh fruit juice

- fresh juice business model

- Fritz Ekwoge

- fruit juice business

- Funding

- furniture

- gabatrans

- gambling

- gardening

- General Tax Code

- General tax Code Cameroon

- ghostwriting services

- Gifts

- Global market conditions

- Global Tax

- goals

- God Di Kam

- Gody Ef.

- graphic design

- green

- grow your business

- GTC

- guarantee wax

- guide

- Guinness Cameroon

- Hairdressing

- handbills

- handbills Posters

- handy services

- Hawkers

- Help Yourself

- Help Yourself First Aid App

- holidaycode

- Home Internet

- Home NoLimit

- House of BKN

- hydroquinone

- Hygiene and Sanitation Tax

- hysacam

- identity design

- Import

- import benefits

- Import Business

- import duty

- Impôt libératoire Cameroun

- impoundment

- impoundment fees

- incentives

- Income Tax

- Income tax Cameroon

- Incorporate a Company in Douala

- incorporate your company

- innovation

- inspectors

- Insurance

- interior decor

- internet disruptions

- internet outages

- InTouch

- inventory

- Invest

- Invest in Cameroon

- investment

- investors

- invoice due

- invoice generator

- invoicing

- IT Job

- Jet car

- Jeunesse Francophone 3535

- job

- Job Opportunity

- Jobs

- Jobs in Bafoussam

- JObs in Bamenda

- Jobs in Bertoua

- Jobs in Buea

- Jobs in Cameroon

- Jobs in Douala

- Jobs in Yaounde

- Jobs in Younde

- Jomo Kenyatta

- Jose Mourinho

- Jovi

- Jovi Lemonstre

- juice business

- Jumia

- Jumia Cameroon

- Jumia Dropshipping

- Jumia Marketplace

- Jumia online shop

- Jumia Seller Center

- Jumia shuts down

- Kadji Beer

- kbm

- Keep Records

- kermannlobga

- Kids

- Kids’ Hall of Talents Foundation

- KnowYourTax

- KnowYourTaxLaws

- Kobo360

- kola

- kola business manager

- Kowan

- kumba

- Kumbo

- Kwacoco bible

- LA LOI DE FINANCES 2019

- LA LOI DE FINANCES 2019 Cameroun

- Ladies

- Lapiro Mbanga

- Laptop

- Laptop Cleaning

- Large Taxpayers

- layette

- LCD Cleaning

- Le Dropshipping

- leaflets

- legal aspect

- legal professionals

- legal requirements

- legal system

- legalize business

- legalize your business

- licensing procedures

- Limbe

- limited capital

- limited company

- Limited company in Cameroon

- Limited Liability Company

- Linux Distributions

- Liquor license

- livestock

- livestock headcount

- LLC

- Local Branding

- Local Construction Materials

- local council tax

- local councils

- Local Product Branding

- local tax

- local tax system

- logging

- logistics

- logistique

- LOI DE FINANCES 2019

- LOI DE FINANCES 2019 Cameroun

- Ltd

- made-in-Cameroon

- Maealth Inc.

- Mahima

- MAISCAM

- maize

- make-up

- Makonjo Media

- manager of shipping property

- Manual of Tax Procedures

- March 15

- marine expert surveyor

- Market conditions.

- market fees

- Market rates

- market research

- marketing

- marketing research

- Marketing Strategy

- Marriage

- Married SIngles

- Martin Luther King

- massage therapy

- Matibabu

- MAXI price

- Mbanga

- Mboko

- Mechanized farming

- medical services

- Melinda Gates

- Messenger Kids

- MINI price

- Minister of Finance

- Ministry of Commerce

- Minor Child Shareholder

- Minor Shareholder

- Miriam Makeba

- Mistakes

- mistakes in business

- Mobile App Development

- Mobile portability

- Mode

- modern agricultural

- modern agricultural techniques

- Modern agriculture

- Modern farming

- Mohamed Ali

- mom business

- Monthly Tax Declaration

- monthly taxes

- MoPay

- Moringa

- motivation

- Moungo

- Movie Premiere in Cameroon

- MTN

- MTN Cameroon

- MTN Home NoLimit

- MTN Mobile Money

- mtn NoLimit

- MTN Unlimited Bundles

- municipal council

- Music Business

- Music Business Ideas

- Mustafë Bislimi

- mutual credit funds

- Mutual investment funds

- National social insurance fund

- Natural Coconut Oil

- NAVEG Technologies

- NBACA Award

- NEF

- Nelson Mandela

- Next Einstein Forum

- Nexttel

- Nexttel Cameroun

- Nexttel Possa

- Nexus Digital Pro

- Nigeria

- njangsa

- njangsang

- Njorku

- NoLimit

- Non-profit private education

- Non-salaried workers

- NSIF

- nursery & primary school

- nursery school

- obligations

- Offshore Vessel Chartering Services

- OHADA

- OHADA accounting system

- OHADA regulations

- OHC

- on-the-spot check

- One-stop shop

- online bet

- Online business

- online business in Cameroon

- Online Community Manager

- Online Fraudsters

- online gambling

- Online Payroll Services

- Online Reputation Management

- Online Tax Calculator

- Open-end investment companies

- OpenHub Co-working Space

- openhub consulting

- OpenHub Consulting Ltd

- OpenHub Digital

- operating criteria

- or mutual funds

- Orange Cameroun

- Orange Money

- order

- ORM

- Otang

- Otto Akama Zuoix

- OTVP

- Ouleu

- packaging design

- Paper Bags

- parking fees

- Patrice Lumuumba

- Paul Mbua Babila

- Paying Taxes

- Paying Taxes in Cameroon

- payment procedures

- Payroll Calculation

- peak performance

- PECB

- PECB Africa and Middle East

- penalties

- penalty

- Penn’s

- Penn’s Natural Coconut Oil

- persona income tax

- Personal capital

- Personal expense

- Personal income tax

- Personal income tax Cameroon

- Personal Income Tax in Cameroon

- Personal savings

- personalized assistance

- petites annonces

- petroleum sector

- petroleum tax

- Photography

- pineapple juice

- PIT Cameroon

- Pitch AgriHack 2023

- Plastic Pollution

- playground fees

- plc

- PME

- pmuc

- pool investments from various investors for a shared investment goal.

- portabilité

- Positive living

- posters

- Pour Over Coffee

- PPC

- pre-finance

- Pre-sales

- Pre-sales funding

- primary school

- Prime Minister

- print advertising

- Print broker

- Print Business

- Print specialist

- printers

- private company

- private limited company

- private limited liability company

- prix Jeunesse Francophone

- prize competition

- procurement

- Product

- Product Branding

- product inspection

- profile

- Profitability

- programming

- projects

- Promotion of Local Processing

- proper invoice

- Property Tax

- Property Tax in Cameroon

- prublic limited companny

- public company

- public safety

- public thoroughfare

- Purchase order funding

- qms

- quality assurance

- Quality Control

- quality control consultancy

- quality control consultant

- quality control management

- quality control manager

- quality management system

- quarry products transportation tax

- quay ticket

- questions

- rasing funds for business

- rates

- react / react

- reboot your business

- recyclage

- Recycling

- Reduced Company Tax Rates

- Referral Marketing

- Referral marketing tactics

- register a company

- register you business

- Register Your Business

- register your company

- Registered business

- registered capital

- regulations

- Reppie

- Reputation Management

- reserved activities

- restaurant

- rice

- RIJLF

- road degradation fees

- Roast Coffee

- Robusta prices

- Rond Point Deido

- Rooted Wraps

- Rwanda

- Salary Deductions

- sales

- sales and marketing services

- sales strategy

- salvors

- SARL

- SAVEN

- sawmilling

- SCDP

- SDGs

- Search engine

- SECAM 2018

- self improvment

- self-help

- Self-Sufficiency

- SEO

- Serial Entrepreneur

- Service Business

- share capital

- shareholder

- shares

- Sharon Ninsiima

- ship assist

- ship brokers

- SHIP CHARTER SERVICE

- ship chartering

- ship management

- ship operation

- ship registration

- ship’s agents

- Sickle Cell

- Sierra Leone

- Sighan

- Silicon Mountain

- Silicon Mountain Conference

- simplified tax system

- single identification number

- sit-at-home moms

- sit-at-mo

- skin bleaching

- Skin Care

- Skin whitening

- Small business

- Small Business Branding

- small business contracts

- Small Business in Cameroon

- small business mistakes

- small business mistakes to avoid

- Small business taxation

- small business taxes

- small business tips

- small businesses

- SME

- social entrepreneurs

- social insurance

- Social Media

- social media management

- Social Media Manager

- social media marketing

- societal order

- Solange Tengu

- sole

- sole proprietor

- sole proprietor business

- Sole trader

- sole-proprietor

- Sole-proprietorship

- sole-proprietorship business creation

- SONARA

- Sorghum

- SOSUCAM

- Source of funding

- Sources of finance

- Soya

- speedi logistics

- Stamp duties

- stamp duty

- Stanley Enow

- start a business in cam

- Start a business in Cameroon

- Start a Small Business in Cameroon

- Start Import Business

- starting a business in Cameroon

- startup registration

- Startups

- startups in Cameroon

- stated capital nominal capital.

- Statistical & Tax Returns

- Statistical and Tax Returns

- Statistical Filing

- Statistics and Tax Return

- Statistics and Tax Return in Cameroon

- Stay positive

- Stimulating Economic Growth

- Stock breeding

- STR

- streamline

- Study Corner

- Styliste

- success

- Supplier financing

- Supply and demand

- supply chain

- supply chain management

- Sustainable Development.

- SVUAC

- Talent Outreach Association

- tanker escort

- target audience

- tasty

- Tata Derick

- Tax

- Tax Administration

- Tax Administration Cameroon

- Tax audit

- Tax audit in Cameroon

- Tax Clearance

- Tax Clearance Certificate

- tax code

- Tax compliance

- tax compliance deadline

- Tax control

- Tax credit

- tax deadline

- tax declaration

- tax digitization

- Tax documents

- Tax exemption

- Tax exemptions

- Tax Exoneration Cameroon

- tax extension

- tax filing

- Tax guarantees

- Tax Guide

- tax identification number

- tax incentives

- Tax Law

- tax liability

- tax management

- tax management in Cameroon

- tax news

- tax obligations

- Tax Officer

- Tax Payment

- Tax planning tool

- tax rate

- Tax rates

- tax regulations

- tax relief

- tax return

- Tax Returns

- Tax rights

- tax systems

- Tax tips

- tax traing

- Tax Training

- Tax Training Workshop

- tax updates

- taxable income

- taxable profits

- taxable wage

- Taxation in Cameroon

- Taxes

- Taxes in Cameroon

- Taxpayer Identification Number

- Taxpayers

- Taxpayers in Cameroon

- TDS

- teacher

- Team

- team management

- Team Members

- team work

- TechCrunch

- Technicien Freelance

- TEF

- temporary occupation fees

- temporary public highway occupation fees

- The Chicago Dark

- The Chicago Medium

- Tikay's Bridal

- time managment

- TIN Cameroon

- TOA

- Togo

- toothpick

- toothpick business

- Touch

- Tour agency

- tourism agent

- Tourist Tax

- Traders

- Training

- Training Workshop

- Travel agency

- travel blogger

- trends logistic

- triconex

- UBA Cameroon

- Uganda

- UIN

- unemployment

- unimited internet

- Unique Identification Number

- unique premium fabrics

- United Arab Emirates

- unlimited internet

- unregistered business

- Urban Jamz Awards

- Vacancy

- Value Added Tax

- value-added tax in cameroon

- VAT

- VAT Calculation

- VAT calculator

- vat in cameroon

- vat invoice generator

- VC

- Venture capital in Cameroon

- verified business

- Verzefé Franck

- Vessel Chartering

- Vessel Chartering in Angola

- Vessel Chartering in Cameroon

- Vessel Chartering in Congo

- Vessel Chartering in Equatorial Guinea

- Vessel Chartering in Gabon

- Vessel Chartering in Nigeria

- Vessels Ship-Broker

- Viettel

- Vitalis Nkwenti

- Wage

- Wan Shey

- Warren Buffet

- Warriors

- Waste-to-Energy Plant

- We endorse

- Wealth Creation

- Web design

- Web design promo

- website building

- website content

- website design

- websites

- Wedding

- Wedding Business

- Weekend In Cameroon

- What's Next?

- wheat

- whitenicious

- wholesale baby products

- Why You Should Have Your Business Registered

- Wise Concepts

- Withholding Tax

- Women Empowerment

- wood briquette

- wood business

- wood carving

- Word-of-mouth marketing

- work from home

- Workshop

- workspace

- World Earth Day

- wreck raisers

- wreck removers

- writing course

- XAF

- Y Combinator

- Yahoo Messenger

- Yamela Technology

- Yaounde

- year-end account

- year-end accounting

- You Don't Know Africa

- Young Holiday

- youth employment

- youth unemployment

- youth wage subsidy

- Zinger Systems

- Zixtech Business

- Zuo Bruno

July 12, 2021

Find service providers in categories of Construction, Health Care, Hospitality, Real Estate, Fashion, Entertainment and many more. Handy Services helps facilitate and ease business interactivity between service providers and their clients.

December 21, 2020

Trends Logistic's Customs Clearing Services in Cameroon

December 15, 2020

Product Inspection Services in China